Decline Rules Set

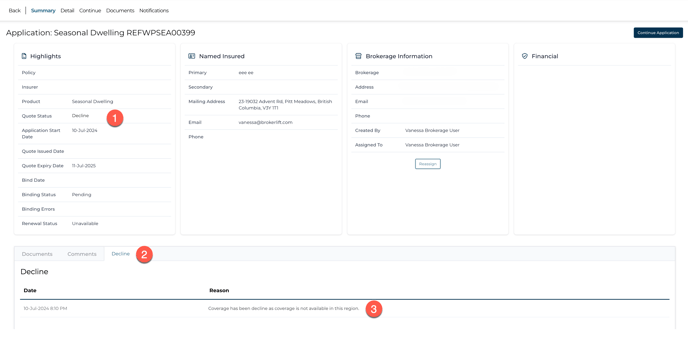

This update introduces a Decline Rule Set and a new DECLINE Status for applications. Applications can be automatically declined based on predefined rules.

Key Features:

-

Decline Rule Set: BrokerLift Products can now be configured to automatically decline applications based on configurable rules, in an identical way as we currently apply Referral rules.

-

New DECLINE Status: A new DECLINE application status. An application is set to a DECLINE status if and when a Decline rule is triggered within an application form. (See 1 in the screenshot above)

-

Decline Reason: Similar to our existing Referrals feature, when a Decline rule is triggered, a new Decline section is added to the Policy Summary page (see 2 in the screenshot). The Decline reason that triggered the DECLINE status will be displayed (see 3 in the screenshot).

-

Application Restrictions: Buttons like "Send to Underwriter," "Issue Quote," and "Bind Policy" are disabled for applications with a Decline status, to restrict further actions.

-

UI Updates: The Rating/Premium widget hides premium amounts and displays a decline message when the application has a DECLINE status.

-

Decline Resolution: Once decline triggers are resolved, the application status reverts to its previous state, removing any action restrictions.

-

Decline Lifecycle Event: A new application lifecycle event is generated when an application is declined.

-

Filter by DECLINE Status: Users can filter applications by the new DECLINE status when searching. Applications with a DECLINE status will show a Premium of “N/A” in search results.

Out of Scope:

-

Manual Decline process by an underwriter (to be implemented in a future update).

This feature provides improved control and visibility over automatically declined applications, enhancing operational efficiency for brokers, underwriters, and applicants.